(Padua/ Italy) – The Board of Directors of Safilo Group S.p.A. has reviewed and approved Q1 2019 economic and financial key performance indicators at May, 9: Safilo closed the first quarter of 2019 with the net sales from Continuing Operations at Euro 247.3 million, up 3.4% at current exchange rates and 0.6% at constant exchange rates (+0.8% on the wholesale business(1)).

Following the Group’s decision announced last April 2, to proceed with the plan to sell the Solstice retail business to a third party, in 2019 management’s comments focus to the Group’s Continuing Operations, excluding Solstice.

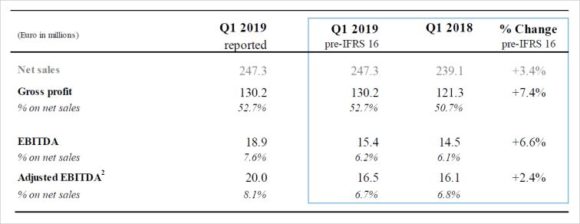

Safilo closed the first quarter of 2019 with the net sales from Continuing Operations at Euro 247.3 million, up 3.4% at current exchange rates and 0.6% at constant exchange rates (+0.8% on the wholesale business(1)). In Q1 2019, Safilo’s adjusted EBITDA(2) from Continuing Operations (pre-IFRS 16) reached Euro 16.5 million and a margin of 6.7%, marking a significant operational improvement compared to the adjusted EBITDA(2) of Euro 16.1 million recorded in Q1 2018, which included the income of Euro 9.8 million for the early termination of the Gucci license.

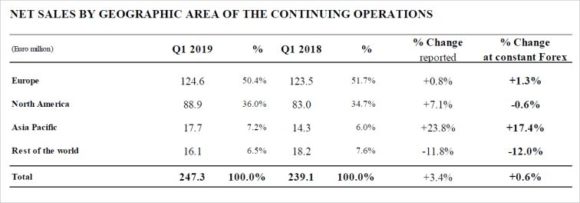

Sales performance was supported by the gradual improvement of business trends in Europe, up 1.3% at constant exchange rates (+1.8% on the wholesale business(1)) and North America recovering a certain stability (-0.6% at constant exchange rates), after the decrease recorded in the last two years. Performance in emerging markets(3) was marked on the one hand by the good results of the Asia-Pacific region, up overall by 17.4% at constant exchange rates, and on the other by a weak business in the IMEA(3) markets.

In the first quarter of 2019, Safilo recorded the overall positive performance of its own core brands, driven by Smith and Polaroid in their core markets and product categories. Positive developments were also evident for a number of licensed brands playing in the fashion luxury and contemporary segments.

First Adoption of IFRS 16

The Group elected to implement IFRS 16, applying the modified retrospective approach, whereby the cumulative effect of adopting the standard has been recognized at its relevant effective date on January 1st 2019, without the restatement of 2018 comparative information. IFRS 16 has a significant impact on the Group’s consolidated balance sheet side due to the right of use assets and lease liabilities that are now recognized for contracts in which the Group is a lessee. In the consolidated statement of income, the majority of the current operating rental costs is now presented as depreciation of right to use assets and interest expenses on the lease liabilities, with a material positive impact in terms of EBITDA and a minor effect on EBIT and net income.

In 2019, key financial indicators are commented on a pre IFRS 16 basis in order to support the transition and to allow proper comparison with the previous period.

Economic and financial highlights of the continuing operations

In Q1 2019, reported adjusted(2) EBITDA of the Continuing Operations reached Euro 20.0 million. On a pre-IFRS 16 basis, excluding the positive accounting effect, equal to Euro 3.4 million, of the first application of the new standard to Q1 2019, the Group’s Continuing Operations posted an adjusted(2) EBITDA of Euro 16.5 million, with the margin on sales standing at 6.7%. For Safilo, this result marked a significant operational improvement compared to the adjusted(2) EBITDA of Euro 16.1 million reported in Q1 2018, which included the income of Euro 9.8 million for the early termination of the Gucci license.

In Q1 2019, the Group’s economic performance grew in fact 200 basis points at the Gross margin level, from 50.7% to 52.7% of net sales mainly thanks to higher plant efficiencies and lower obsolescence costs, and recovered additional 200 basis points at the operating expenses level following the ongoing progress in the overheads saving program.

At the end of March 2019, total Group Net Debt on a pre IFRS 16 basis stood at Euro 26.4 million compared to Euro 166.0 million in Q1 2018 and Euro 32.9 million at the end of December 2018. Q1 2019 Net Debt benefitted of the remaining proceeds, received on January 2, 2019 and equal to Euro 17.7 million, from the share capital increase. Following the first application of the new IFRS 16 standard to Q1 2019, Group Net Debt stood at Euro 105.7 million.

Notes:

(1) The wholesale business excludes the business of the production agreement with Kering, reported within the geographical area of Europe.

(2) In Q1 2019, the adjusted EBITDA excludes non-recurring costs for Euro 1.1 million, due to restructuring expenses related to the ongoing cost saving program. In Q1 2018, the adjusted EBITDA excluded non-recurring costs for Euro 1.7 million, mainly related to the CEO succession plan, and it included an income of Euro 9.8 million, as pro-rata portion of the accounting compensation for the early termination of the Gucci license, equal to Euro 39 million for the full year 2018.

(3) Emerging markets comprise the regions of India, Middle East & Africa (IMEA) and Latin America (reported within Rest of the World), Central Eastern Europe (reported within Europe), Greater China and APAC (reported within Asia Pacific).